时间:2024-03-15|浏览:307

译文作者:0xEvan, Primev

原文标题:Blob 市场中的审查、延迟和预先确认

来源:镜子

编译:Franci,ETHconomics 研究空间

译者导读

前面我们发的几篇文章都和 blob 交易本身以及 4844 费用相关,而在这篇文章机制中,作者通过对过去一年的数据回测,以模拟 blob 市场的潜力——它可以承载多少数据?能否满足rollup的数据可用需求?

除了blob空间的供需曲线对blob市场会造成影响之外,验证者的时间博弈以及构建者的审查也对这个市场带来一些负面影响。本文对可能产生的blob交易广播延迟进行有了数据分析,由此产生的用户体验、汇总数据可用开销影响进行了转型,也提出了可能的解决方案——预确认 blob 交易。

总的来说,这篇文章是比较全面的blob市场分析,读者大可以通过文章的脉络,探索未来blob空间的格局。

正文:

特别感谢@terencechain的审阅、@BertKellerman的意见和@ethpandaops提供的holesky测试网数据。

长话短说

我们的研究深入探讨了新兴的EIP-4844 blob市场,该市场的运行方式与EIP-1559的gas定价方式类似。不同的是,它直接针对区块链建设者的小费机制,因而没有激励其储备blob 交易,这可能导致 blob 交易体验不稳定,以及预留进区块有一定的挑战。

我们注意到,虽然 blob 交易容量很大(约 125 kB)且比同等大小的通话数据便宜,但它们大大增加了以太坊区块的大小。这也意味着 blob 交易给区块带来了增量的竞价能力。

我们利用这个新市场的容量能够吸收当前rollup的数据需求,将标准区块空间的gas成本降低15-20%,从而解锁了更明显的mev机会。

我们观察到,在网络活动增加的时期,blob 交易可能会使区块广播速度减慢几千几千的数量级,这可能导致区块构建者为了在 mev-boost 中维持具有竞争性的竞价并审查 blob 。

我们评估,“预确认出价”可以缓解这些挑战,blob预确认可以增强EIP-4844的能力,为L2用户提供更好的交易体验,以及为rollups提供稳定的交易备用体验。

我们将在Holesky测试网上进行,收集区块构建者数据,并通过mev-commit将relay作为blob预确认成功,我们邀请PBS实验的相关参与者来一起进行实验。

引入

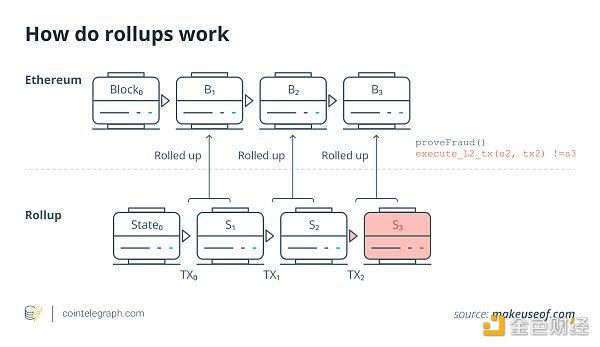

EIP-4844引入了一个blob市场,从而扩展了以太坊的数据可用性。这个新兴市场使用类似于EIP-1559的gas价格机制来定价和汇率blob的基本gas费用。然而,与type2交易不同的是,blob 市场中用户没有直接的方式出价给构建者作为,节约其 blob 的小额费用。缺乏优先收费的设计使得准确定价 blob 节约费用变得困难。此外,预计 blob 的区块在网络中的广播中会变慢,因为 blob 是以太坊交易类型中最大的一种。如果构建者在一个区块中接受许多 blob,他们可能会面临更高的区块重组风险,因此,假设构建者是经济学方面理性的人,其可能会选择在mev高峰期审查blob,以保持块构建的低延迟。

我们提出了一个与 blob 相关的区块构建和 mev-boost 数据收集工作,以及一个使用 mev-commit 的 blob 预确认实验,并邀请社区中的 rollup、relay、区块构建者和发起者参与我们对 EIP-4844 中 blob 相关行为的意见表明,L1 blob 预确认可以增强 blob 市场带来的功效,为 L2 用户提供更好的交易体验,为 rollup 在出现 mev 条件下提供可靠的资源体验,以及给rollup为中心的以太坊路线图提供一个更稳定的未来。

理解 Blob 市场

斑点交易

EIP-4844 引入了一种 type3 交易(称为 blob 交易)。进行 blob 的交易亦类似于常规交易,但增加了 blob 数据、KZG 承诺和证明。与标准以太坊交易相比,Blob 极大(约125 kB),且比等量的calldata便宜。Calldata的价格为每个非零字节可16gas且大小变化;而blob数据的价格为每字节1.04gas,且每个blob上限为131,072气体。

斑点气体机制

Blob 基础气体定价随着定价网络的堵塞情况的费用而变化,这与 EIP-1559 类似。主要机制区别在于,blob 基础气体的价格基于 Blob 使用数量,而 EIP-1559 是基于上个区块气体的利用率变化(使用的gas数量之于目标gas数量而言)。目标Blob的数量是3(0.375 MB),每个区块的最大数量是6(0.75 MB)。Blob基础gas价格简单设置为1 wei 。

当提交一个blob交易时,发送者将提交max_fee_per_blob_gas作为他们愿意为blob基础gas费支付的最高价格,所有这些费用都将被纳入考虑。max_fee_per_blob_gas与type0和type2交易中的max_fee_per_gas类似。如果用户想提交额外的费用以预算其交易为主,那么他们还会提交max_priority_fee。然而,max_priority_fee仅覆盖交易中非blobgas部分。也就是说,这种blobgas费用机制下用户不能直接提交blob预算小费给构建者。

(原文者注:关于4844费用机制原理分析,我们社区撰写了更详细的文章,请看这里)

Blob 市场容量

在本节中,我们对2023年1月到2024年1月期间rollup网络的历史交易活动进行了回测,以展示blob市场的结构。我们关注以太坊上最活跃的rollup的交易,并利用历史数据它来了一个模拟实时的 blob 市场。当然,这个市场正在积极增长,且 blob 尚未在主网上线,论文使用了整个 2023 年的历史数据,旨在模拟的潜力。

Based on the historical calldata activity of rollup and simulating its use in the block space of type3 transactions, we can see that the blob market price can easily absorb all the capacity of the rollup without causing the blob market price to exceed the blob base gas minimum value ( That is 1 wei).

Figure: base blob gas per block

Although the rollup publishes more data to Ethereum, most blocks are still below the target blob number, which ensures that blob gas prices remain low.

Figure: The lighter the color, the more times a block that packs a specific number of blobs is built.

This means that the calldata overhead of the blob market will be lower (calldata consumes 16 gas per byte, while blob consumes 1 gas per byte), and the gas price will also be lower (the gas price of calldata is gwei level, while blob The gas price is at the wei level), thus saving two additional layers of costs for rollup.

Not only can the blob market easily absorb the data availability needs of current rollups, it can also enable non-blob markets to free up more block space and reduce gas overhead by more than 15-20%. The reduction in gas overhead in turn increases the bidding power of users/searchers, builders, and validators, and unlocks new mev opportunities that were priced out prior to EIP-4844.

Figure: Impact of EIP-4844 on standard block space (based on 2023 data)

Rollup requires more data availability

Rollup greatly affects the gas usage in the block. They are currently the largest type of gas users in the Ethereum block space. In 2023, rollup stored a record amount of transaction data on Ethereum, as shown in the figure below:

Figure: Calldata saved on Ethereum hits record high

The daily average chart below shows that rollups are starting to occupy more than 15% of each block they are in, directly affecting the price of use for other users.

This may worsen in the event of a black swan and increased demand. As recently as December 2023, the inscription craze caused excessive transaction volume, causing Arbitrum’s sequencer to be offline for about an hour. When the Arbitrum sequencer resumed operations and began publishing the backlog of saved state data, the sequencer immediately monopolized the entire block space, causing the gas price to soar to more than 140 gwei, consuming up to 90% of the gas in all blocks, making The network was unavailable to most users for several hours.

In the next section, we discuss how timing games and censorship might impact this market even in the absence of this surge in demand.

Challenges Facing the Blob Market: A Review

Broadcasting of Blob transactions

EIP-4844 increases the bandwidth requirements per beacon block by up to ~0.75 MB, 42m gas, to accommodate up to 6 additional blobs per beacon block. Unlike calldata, which is stored permanently, blobs persist in beacon nodes for a short period of time (18 days as of February 2024) to keep the growth of the network's archived state under control.

Additionally, blob transactions have two network representations – a blob transaction for block builders and a blob sidecar for validators. Blob sidecars are designed for forward compatibility.

The blob must first be broadcast through the execution layer and then to the consensus layer. **This means that the builder (not the validator) has the final say on blob packaging. **Proposers can only exclude blob transactions under mev-boost dynamics based on invalid promises/proofs.

Figure: Execution verification is performed by builders, consensus verification is performed by validators

A Block Builder’s Perspective

Recent research on validator “timing games” highlights how latency optimization can strategically enable node operators to maximize profits by delaying block proposals. The authors explain that this is detrimental to the health of the chain. Blob transactions further complicate this game by adding varying amounts of latency when the blob sidecar broadcasts.

Blob transactions are equivalent to the largest possible transaction size type. For this reason, blocks carrying these transactions propagate more slowly, making block builders less competitive in winning mev-boost bids. As a result, this incentivizes block builders to review blobs temporarily or even indefinitely so that they can submit mev bids with greater frequency.

The ethpanda team has been testing real-world latency on testnet using Xatu. They have observers set up in multiple locations around the world (NYC, FRA, BLR, SYD) using different Ethereum consensus clients (Prysm, Nimbus, Lodestar, and Lighthouse) to measure real-world latency. The February 20, 2024 Holesky Blob data snapshot shows that a large amount of latency is generated throughout the mev pipeline.

After a block builder wins a mev-boost bid auction, the proposer must wait for the blob sidecar to be broadcast before validating the blob packaged in the block. The following table shows that with a sample size of 800 blob sidecars, the minimum time for a single blob sidecar broadcast is approximately 400 milliseconds

Chart 1. Blob broadcast time vs. number of blobs contained in a single slot

Figure: The small size of the data is one reason for some of the counterintuitive observations described in this dataset.

The table below shows the difference in latency when waiting for more blob sidecars to arrive. The 50th percentile (p50) in the table shows that the difference in latency between a block carrying 2 blobs and a block carrying 6 blobs is approximately 225 milliseconds.

Chart 2. Time difference between the first arriving and last arriving blob sidecar out of the total number of blob sidecars grouped by block

This blob broadcast delay creates additional block reorganization risk for block builders, who receive minimal financial gain when filling their own blocks with blobs. Builders may choose to exclude/censor blob transactions to avoid potential reorganizations. If a block contains a large number of mevs, economically rational builders need to appropriately compensate for this risk by rolling up the network.

About the user experience of package bidding in the Blob market

In this paper on the study of the validator time game, it is pointed out that later in the mev-boost bidding process, larger bids are associated with larger blocks. As the bid and gas price rise, a larger share of ETH will be destroyed in subsequent slots. If the base fee increases, but the mev withdrawal amount remains the same, the builder has less room to bid on the proposer's future revenue.

Translator's note:

(Value inflow: MEV + handling fee

Value outflow: destroyed ETH + Proposer’s PriorityFee + builder’s tip to Proposer + builder’s own income)

In other words, if more is destroyed, less will be given to the proposer.

Anticipated blob market where capacity exceeds current demand. The destroyed blob base fee will remain on a very small order of magnitude, i.e. tens or hundreds of wei. This is critical for rollups to understand: even if they pay enough base fees, their blob transactions may not be included. The low base fee of the blob market means that blob transactions require bids many times higher to incentivize builders to package such transactions. In this case, the blob transaction will have to be resubmitted at a higher fee, resulting in a poor user experience.

此外,由于EIP-4844下的初始blob市场没有打包小费机制(例如blob优先gas费),这进一步加剧了用户体验问题,因为rollups无法直接竞价竞争打包blob交易中的空间。

我们看一个交易示例,假设 Blob 基础 Gas 费用为 10 wei,并计算相同数据量的 Blob 开销。 应该注意的是,该示例假设存在可以竞价 blob 空间的有效包竞价机制。

请看交易样本:

Calldata - 129,998 字节(129429 个非零字节)~ 10.56 gwei 使用的 2,094,140 Gas(10.55 gwei 基本价格 + .01 gwei 优先费)= 0.022 ETH

Blob-128,000bytes~131,072gasusedat1gwei(10weibaseprice+.99999999gweipriorityfee)=0.000131072ETH

计算得出的结论是,如果 Rollups 使用 Blob 市场,由于 Blob 基本费用较低,他们可能会提交 100 倍以上的出价,同时还可以节省超过 150 倍的成本。 较低的 blob baseFee 将允许 rollup 提供更具竞争力的出价,同时节省开销。 打包费需要与该区块现有的机电项目机会一样具有竞争力,以补偿建筑商潜在的重组风险,因此即使出价高出 100 倍也可能不够。 这是没有 blob 预验证的情况。

通过 mev-commit 进行 Blob 预验证

在这个时间博弈中,blob预确认的主要作用是让一些预确认的blob在mev管道上可用。 通过 mev-commit,每个预确认提供商对交易做出自己的承诺。 然后,提供者可以将此数据委托给其他参与者(例如块构建器、中继器、定序器)。 MEV 管道中其他参与者可用的预确认数据允许块构建器并行发送匹配的执行负载。 可以利用这个概念来创建预先确认的 blob 装箱列表,或通过中继协作构建 type3 块空间。

因为预先确认的 blob 是预先知道的,所以区块构建者可以在其槽位开始之前构建携带 blob 的未来区块。 这种做法提供了定价依据,为建设强大的期货市场奠定了基础。 市场将为rollups提供更可靠的交易打包体验,让区块空间价格更加稳定。 此外,mev-commit 的预确认竞价为 rollup 提供了更可靠的价格发现机制,因为 rollup 可以实时更新其预确认竞价,而无需重新提交整个 blob 交易。

最后,捆绑 blob 并使用预确认投标允许汇总形成联盟。 预确认竞价可应用于捆绑的 Blob 交易或聚合的 Blob,允许在 Rollups 之间共享竞价权和打包空间,有助于促进以太坊 Blob 市场的稳定和持续发展。

综上所述

Overall, our research shows that the economics of rollup are improving, while the emergence of new markets requires more factors to be considered, including the impact of time games and the lack of a tipping mechanism. It’s too early to move into the solution phase for the issues we highlighted, but since mev-commit is activated on the Holesky testnet, we can easily conduct experiments with PBS behavioral entities. Primev will collect data on the impact of blobs on block construction and proposer latency, and hopes to understand underlying behavioral patterns.

While economics and user experience are the main drivers for pre-confirmed Type 2 transactions, under EIP-4844, rollups and the rollup-centric transaction packaging experience, reliability and stability of the Ethereum ecosystem will become the key drivers for pre-confirmed blobs. important reason. We will also experiment with a blob pre-confirmation relay, which can leverage blob pre-confirmation and block builder coordination to improve blob sidecar broadcast latency issues on the Holesky testnet. We invite the community to participate in this experiment as it will provide potential solutions for the entire community.

用戶喜愛的交易所

已有账号登陆后会弹出下载