时间:2024-03-12|浏览:261

Original author: Edgy

Original source: twitter

Compiled by: Deep Wave TechFlow

Although the current market is good, when the bull market ends, most people will lose money.

They make preventable mistakes and lose life-changing fortunes.

So, here are 15 mistakes to avoid in a bull market (and how to prevent them):

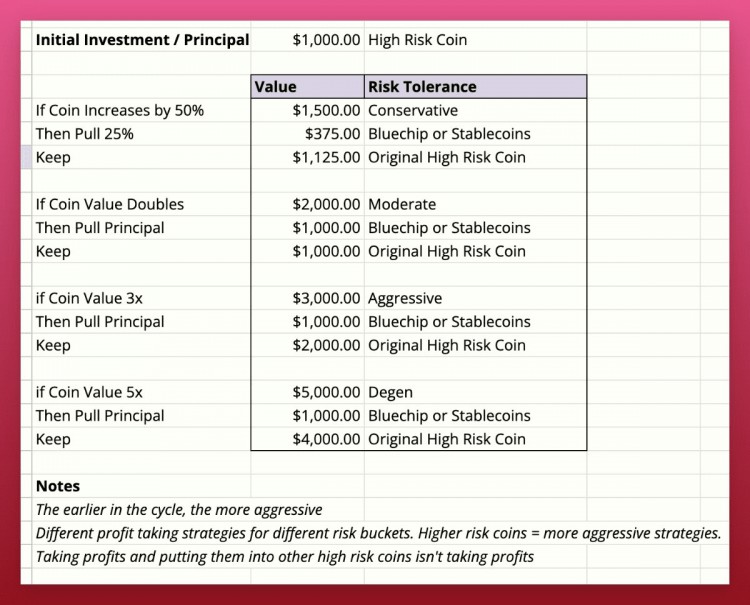

1. Not taking profits

No one cares what your portfolio peaked at, what matters is what you have left at the end of the cycle.

Below is an example of a system that you can adjust based on your risk tolerance.

Tips:

If you feel like an investing genius or are taking screenshots to show off your gains, it’s time to take profits.

Taking profits means exchanging some currency into fiat currencies, stablecoins or tokens for long-term investment rather than plowing it into riskier projects.

Make a cycle exit plan for yourself.

Chances are you've picked up some bad habits during the last two years of bear markets. Strategies that work in a bear market don't work in a bull market.

Here are some examples of bad habits…

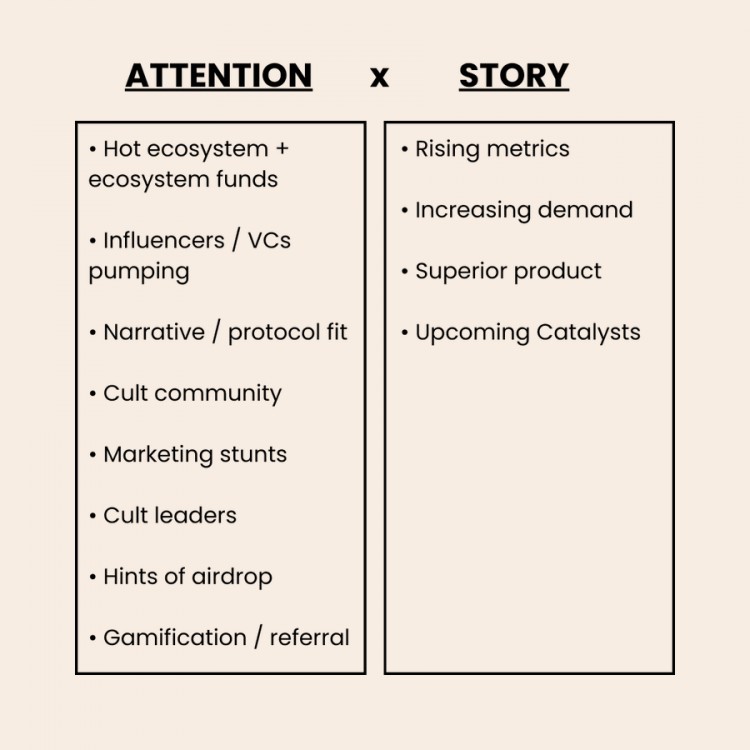

2. Focus on fundamentals rather than upside

Bull markets are all speculative.

Look for projects that meet the following criteria:

can generate hype

There is a simple and easy to understand story. Can people understand why prices will rise in the future?

Too much fundamental analysis will ruin you.

3. Changing positions too quickly

Remember how narratives appeared and disappeared in a matter of days during a bear market?

Why? Existing market + lack of new liquidity = rapid change of market hot spots.

In a bull market, narratives last longer because there is more liquidity. Don't make yourself lose profits by changing positions frequently.

4. Potential energy weakens

The total cryptocurrency market capitalization price has increased by 100% in the past few weeks.

You think it's "too expensive" and you wait for a pullback that never comes.

It will go up a further 10x because this is a bull market.

Price is a narrative.

5. Riding the trends

You have to spot trends early, ride them as hard as you can, and get off before they stall.

Spot trends early (spot waves)

Investment (riding the wind and waves)

Make profits along the way and get out before the crash

6. Don’t think like a retail investor

Crypto Twitter does not equate to the entire crypto space. You end up with too many flywheels and governance issues that no one wants.

You should spend time on Tik Tok, IG (Instagram), Reddit and YouTube. To understand ordinary people, you have to spend time with them.

7. Don’t narrow the scope of the narrative

There should be 2-3 narratives that you focus on.

I know you want to "catch every opportunity on the upside," but if you spread yourself too thin, you won't have any advantage.

I think the following sectors will do well in this cycle:

AI

RWA

LRTfi

Depending on

Meme

Brc20

GameFi

L1/L2

8. Pursuing excessive returns

Staking tokens to earn airdrop points? don't want.

Deposit tokens to get an extra 8%? It’s not worth the risk of smart contracts.

Remember those fools who deposited their tokens into Celsius to get an extra 5%?

Don't do this, you want their interest and they want your principal.

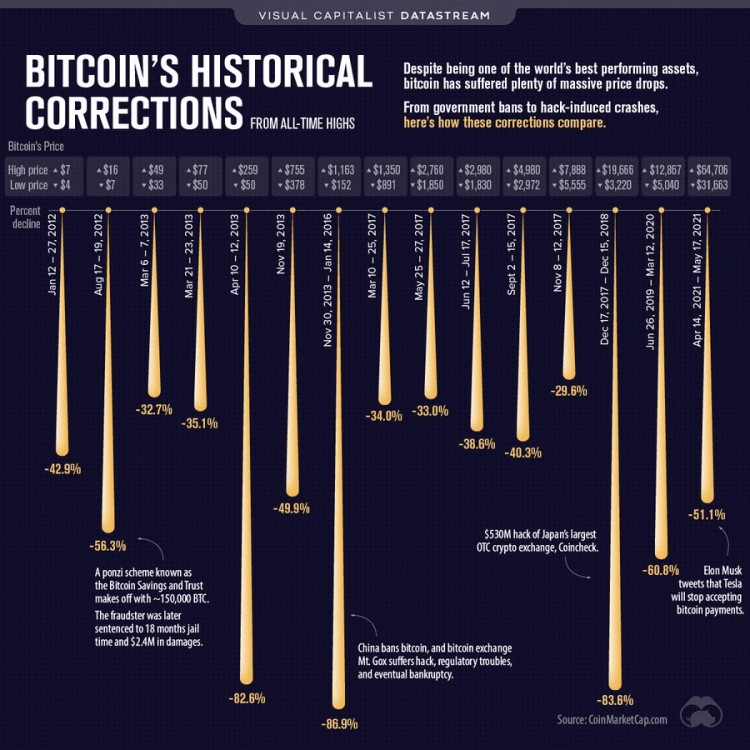

9. Panic during pullbacks

There will be many pullbacks on the way to the highs. They are healthy and expected for the market.

At this time, the leverage should not be too high, otherwise the position will be liquidated.

Don't try to predict every pullback either.

10. Investments are too diversified

I've seen people post portfolios online before that have more than 25 tokens.

You can’t keep up with that many projects.

And if one of the coins goes up super high, you’re not going to get that much return on your total position.

I think 5 - 7 tokens is the sweet spot.

Here is a simple portfolio for reference

Long-term holding: BTC, ETH or SOL

Narrative 1: Sector Alpha (leading) and coins that are likely to obtain excess returns

Narrative 2: Sector Alpha (leading) and coins that are likely to obtain excess returns

Narrative 3: Sector Alpha (leading) and coins that are likely to obtain excess returns

11. Pursue comparison

It’s easy to feel like your earnings are mediocre relative to the earnings of everyone else on Twitter.

There is survivorship bias in the market, don’t be too FOMO

I've seen this happen countless times.

Your coins can achieve 10x results

But you feel like you're not as good as others

Then chasing 50x returns, which ultimately leads to your failure

Finally got $0 profit

You might as well take profits gradually and don't compare too much.

12. Don’t try to sell at the top

No one can time the peak of a cycle perfectly.

Many people have lost fortunes because they tried to sell the "top" but didn't time it right.

solution? Just sell gradually during the rise.

13. Revenge trading

If I lose money in poker, I will continue playing and become more aggressive in trying to win my money back. But this rarely works.

Don't do this in cryptocurrencies. When you are losing money and are emotional, it proves that now is not the time to trade.

14. Stop loss not fast enough

No one has a 100% winning rate. It's okay to fail, but it's not acceptable to persist as a loser.

Set some conditions before entering a trade. For example, if the price falls by more than 15%, stop the loss.

You ask, “But what if I sell it and the price goes up?”

But the reality may be:

What if you hold it and it goes to $0?

What if it stays stagnant and you can allocate it to other 10x coins?

There is an opportunity cost to your capital.

15. Understand investor psychology

Keep in mind that results vary from cycle to cycle. We can have shorter or longer cycles.

Stay flexible.

One thing remains constant: human psychology. Understand the herd mentality and greed mentality.

I know you're excited about rising markets. But I have seen countless people overestimate their abilities midway, resulting in profit taking.

Keep things simple and keep a clear head.

用戶喜愛的交易所

已有账号登陆后会弹出下载