时间:2024-01-17|浏览:301

With the approval of a BTC spot ETF, the crypto world can finally start focusing on the next big thing. We are seeing early signs of ETH and ETH proxy rotation, as well as what appears to be a clear reversal in the ETH:BTC ratio.

ETH price has significantly lagged BTC and other Layer 1s as cryptocurrencies emerge from the bear market in 2023. However, fundamentals remain as strong as ever. Alternative layer 1s like Bitcoin and SOL are the narrative drivers of 2023, but we are seeing the first signs of a massive shift toward Ethereum and ETH layer 2. My expectation is that this new fundamentals-driven narrative will ignite ETH and a few other ETH proxies into a mission to the moon, and now is the time to start loading up the baggage.

MATIC

Polygon 2.0 is a major innovation in Layer 2 scaling. Essentially, it is a new system of Validium zkRollups, with all functionality running on a common interop layer based on Ethereum.

Without getting too technical, it's a ZK rollup system (basically layer 3) that all settles to an intermediate ZK rollup called the interop layer (layer 2), which then batches all transactions and settles them into Ethereum. The result is that you can have an "unlimited" number of chains built using Polygon CDK, all using their own custom parameters, and all connected back to the same interop layer, sharing liquidity pools on the same network setup, and perform local settlement to Ethereum. Even the existing PoS Polygon we all know and use will be connected to the interop layer.

The beauty of this system is that adding new chains is very simple and permissionless, requiring only future chains to incentivize validators with POL tokens (or even USDC or ETH). The same validator can validate any number of chains simultaneously.

As part of the Polygon 2.0 upgrade, the migration from $MATIC to $POL is planned for the first half of 2024 and is already underway on the testnet. Well-known chains and projects such as OKX, Astar, Immutable, etc. are committed to building with Polygon 2.0 CDK. Given that all token unlocks are complete and inflation is only 2%, expect the price to really take off when POL 2.0 rises in the second half of this year.

I have been adding to my capital over the past few weeks and will continue to buy dips with the goal of holding the bull market for the long term. Risks are expected to be 15-20 times lower this cycle.

ARB

Arbitrum is a strong competitor to MATIC, being an L2 and outperforming MATIC on most metrics. One caveat with Arbitrum is its poor token economics and value accumulation. That said, $ARB’s fundamentals and widespread adoption outweigh the shortcomings caused by sub-par token economics, which will likely be addressed over the next 18-24 months anyway.

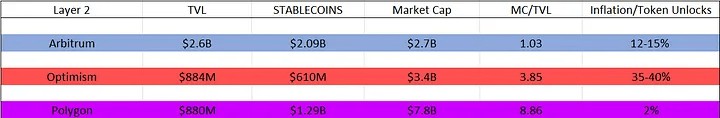

Arbitrum is arguably the largest chain after ETH and BSC, even beating SOL on multiple metrics. It has the lowest market cap to TVL ratio at 1.03. For comparison, $ARB currently has a MC of $2.7B, while Optimism’s MC is $3.3B. Optimism owns a third of the stables and TVL, and 1/10 of the daily trading volume.

Arbitrum’s performance is far superior to any other layer 2 on ETH. Where it falls short compared to Polygon is inflation and token unlocking, as well as the accumulation of token value. $ARB also has a solid SDK and Optimistic rollup technology stack, but it is technically inferior to Polygon’s zkRollups, with longer settlement times, lower throughput, and a lack of global liquidity.

As a layer 2, it is the most undervalued according to the above metrics, but it is closely followed by Polygon due to inflation and the shortcomings of token economics.

Immutable is a Gamefi giant with huge potential. It's difficult to compare to ARB and MATIC because it's a raw Zk-rollup with a unique set of technical differences. It's also up quite a bit compared to ARB and MATIC, but with plenty of catalysts on the horizon, there's plenty of room to run.

IMX will transition to Polygon 2.0 CDK this year and will likely do well as it gains the benefits of global liquidity and native interoperability with existing Polygon PoS. The target here is 15-20X.

in conclusion

ETH is finally waking up from its slumber, marking a clear reversal against BTC, and is heading towards my bullish goals of 18-20% ETH dominance and 0.1-0.12 BTC per ETH, which is effectively two-digit gains for ETH relative to BTC times.

Ethereum FUD reached its peak about three weeks ago when crypto Twitter went wild with chants of “Ethereum is dead.” This cacophony signals a perfect buying opportunity, and while we should never count on buying those leather bottoms, we are now at an excellent point in the bull market, ETH is starting a macro trend reversal, and will likely provide excess low risk reward. For those like me who are more passionate about cryptocurrencies, ETH Layer 2 provides amplified returns as a proxy for the ETH ecosystem. Pack your bags and enjoy the journey.

用戶喜愛的交易所

已有账号登陆后会弹出下载