时间:2024-01-02|浏览:262

又一年,我们 NewsBTC 团队推出了另一个加密货币假期特别节目。 在接下来的一周,我们将剖析 2023 年的跌宕起伏,揭示未来几个月可能为加密货币和 DeFi 投资者带来的变化。

和去年一样,我们致敬查尔斯·迪克的经典著作《圣诞颂歌》,并聚集了一群专家来讨论加密市场的过去、现在和未来。

通过这种方式,我们的读者可能会发现一些线索,让他们能够穿越 2024 年及其潜在趋势。

与 Blofin 一起度过加密货币假期:深入探讨 2024 年

我们与加密货币教育和投资公司 Blofin 共同结束了本次假日特别活动。

在我们 2022 年的采访中,布洛芬谈到了 FTX、三箭资本 (3AC) 崩溃和 Terra (LUNA) 造成的影响。

与此同时,该公司预测比特币和加密货币市场将从灰烬中回归。

比特币的复苏似乎正在顺利进行,突破了 40,000 美元大关。

这是他们告诉我们的:

问:鉴于 2022 年和 2023 年观察到的长期看跌趋势,这些时期的严重程度和影响与之前的低迷时期相比如何? 随着比特币现已突破 40,000 美元的门槛,这是否意味着熊市的最终结束,或者投资者是否应该做好准备应对潜在的市场波动?

布洛芬:

与之前的加密货币衰退相比,2022-2023 年的熊市显得更为温和。

与之前的周期不同的是,在上一轮牛市中,稳定币的广泛使用和海量传统机构的进入给加密市场带来了超过1000亿美元的现金流动性,而且大部分现金流动性并没有因为资金问题而离开加密市场。 2022 年一系列活动。

即使在投资者宏观预期最悲观的 2023 年 3 月、流动性触底的 2023 年第三季度,加密市场仍然拥有不低于 1200 亿美元的稳定币形式的现金流动性,这提供了足够的支撑和抗风险能力适用于 BTC、ETH 和山寨币。

同样,由于现金流动性充裕,在2022-2023年的熊市中,我们并没有经历类似2020年3月和2021年5月的“流动性枯竭”情况。2023年,随着加密货币市场的逐步复苏,流动性风险也随之降低。与 2022 年相比大幅减少。

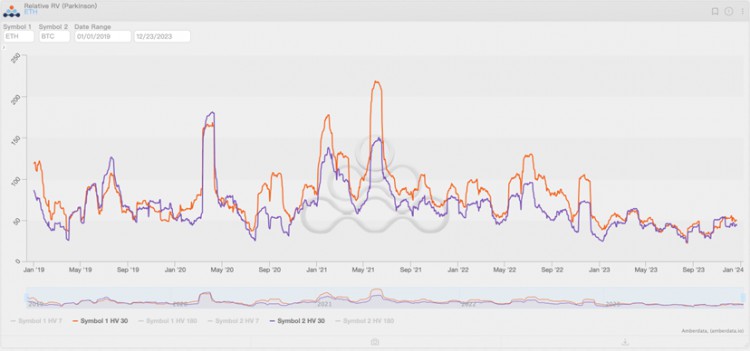

唯一令人不安的是,2023年夏秋两季,超过5%的无风险回报让投资者更加关注货币市场,并带来了2019年以来加密市场最低的波动性。

然而,低波动性并不表明经济衰退。

2023年第四季度加密市场的表现证明,更多的投资者实际上是在观望。

他们不会离开加密货币市场,而是在等待合适的时机进入。

Currently, the total market cap of the crypto market has recovered to more than 55% of its previous peak. It can be considered that the crypto market has emerged from the bear market cycle, but the current stage should be called a “technical bull market” rather than a “real bull market.”

Again, let’s start our explanation from a cash liquidity perspective. Although the price of BTC has reached $44k once, the size of cash liquidity in the entire crypto market has only rebounded slightly, reaching around $125b. $125b in cash supports over $1.6T in total crypto market cap, implying an overall leverage ratio of over 12x.

Additionally, many tokens have seen significant increases in their annualized funding rates, even exceeding 70%. High overall leverage and high funding rates mean that speculative sentiment has as much impact on the crypto market as improving fundamentals. However, the higher the leverage ratio, the lower the investors’ risk tolerance, and the high financing costs are difficult to sustain in the long term. Any bad news could trigger deleveraging and cause massive liquidations.

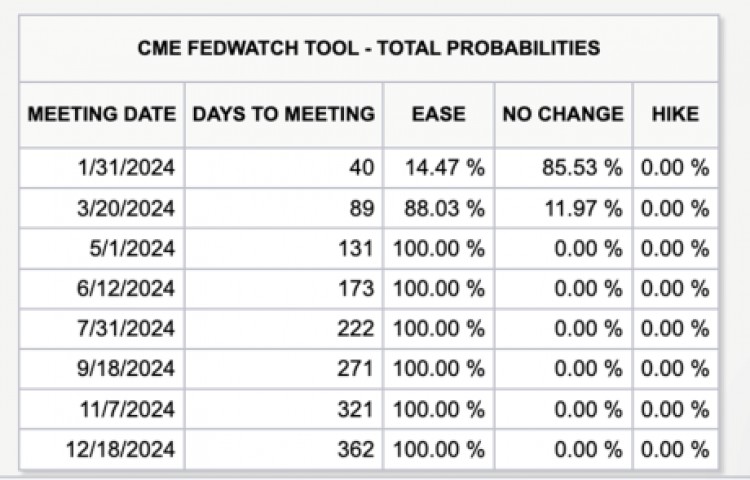

Furthermore, real improvements in liquidity are yet to come. The current federal funds rate remains at 5.5%. In the interest rate market, traders expect the first rate cut by the Federal Reserve to occur no earlier than March and the European Central Bank and Bank of England to cut interest rates for the first time no earlier than May. At the same time, central bank officials from various countries have repeatedly emphasized that interest rate cuts “depend on the data” and “will not happen soon.”

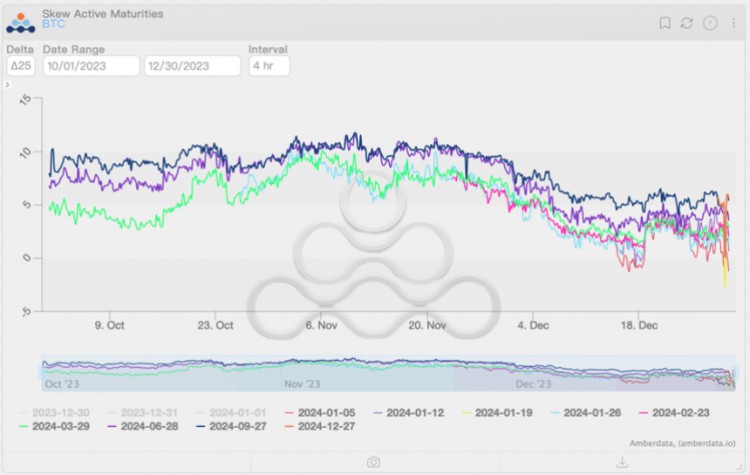

Therefore, when liquidity levels have not really improved, the recovery and rebound of the crypto market are gratifying, but the “leverage-based” recovery is significantly related to investors’ financing costs and risk tolerance, and the potential callback risk is relatively high. In fact, in the options market, investors have begun to accumulate put options after experiencing a rise in December to deal with the risk of any possible pullback after the start of 2024.

Q: Right now, we are seeing Bitcoin reach new highs. Do you think we are in the early days of a full bull run? What has changed in the market that enabled the current price action; is it the Bitcoin spot ETF or the US Fed hinting at a loser policy or the upcoming Halving? What is the big narrative that will go on in 2024?

Blofin:

As stated above, we are still some way away from the early stages of a full-blown bull market. “Technical bull market” better describes the current market status. This round of technical bull market started with improved expectations: the spot Bitcoin ETF narrative triggered investors’ expectations for the return of funds to the crypto market, while the peak of the federal funds rate and expectations for an interest rate cut next year reflected the improvement at the macro environment level.

In addition, some funds from traditional markets have tried to be the “early birds” and make early arrangements in the crypto market. These are all important reasons why BTC’s price is back above $40k.

However, we believe that changes in the macro environment are the most important influencing elements among the above factors. The arrival of expectations of interest rate cuts has allowed investors to see the dawn of a return to the bull market in risk assets. It is not hard to find that in November and December, not only Bitcoin experienced a sharp rise, but Nasdaq, the Dow Jones Index, and gold all hit all-time highs. This pattern typically occurs at or near the end of each economic cycle.

The beginning and end of a cycle can significantly impact asset pricing. At the beginning of a cycle, investors typically convert their risky assets into cash or treasury bonds. When the cycle ends, investors will take cash liquidity back to the market and buy risk-free assets without distinction. Risk assets typically experience a “widespread and significant” rise at this time. The above situation is what we have experienced in 2023Q4.

As for the Bitcoin halving, we prefer that the positive effects it brings result from an improvement in the macro environment rather than the result of the “halving.” Bitcoin had not become a mainstream asset with institutional acceptance when the first and second halvings occurred. However, after 2021, as the market microstructure changes, institutions have gained sufficient influence over Bitcoin, and each halving coincides with the economic cycle to a higher degree.

In 2024, we will witness the end of the tightening cycle and the beginning of a new easing cycle. But compared with every previous cycle change, this cycle change may be relatively stable. Although the period of high inflation is over, inflation is still “one step away” from returning to the target range.

Therefore, all major central banks will avoid releasing liquidity too quickly and be wary of the economy overheating again. For the crypto market, a solid liquidity release will lead to a mild bull run. Perhaps it is difficult for us to have the opportunity to see a bull market similar to that in 2021, but the new bull market will last relatively longer. More new chances will also emerge with the participation of more new investors and the emergence of new narratives.

Q: Last year, we spoke about the most resilient sectors during the Crypto Winter. Which sectors and coins will likely benefit from a new Bull Run? We are seeing the Solana ecosystem bloom along with the NFT market; what trends could benefit in the coming months?

Blofin:

可以肯定的是,当牛市回归时,交易所(无论是CEX还是DEX)是最先受益的。

随着交易量和用户活跃度再次开始反弹,可以预期他们的收入(包括交易所的手续费收入、代币上币收入等)将大幅增加,交易所代币的表现也可能会受益于此。

同时,与交易和资金流通相关的基础设施也将受益于新的牛市,例如公链和Layer-2。

当流动性回归加密市场时,加密基础设施是不可或缺的一部分:流动性必须首先进入公链,然后才能转移到各个项目和底层代币。

在上一次的牛市中,以太坊网络的拥堵和高昂的gas成本受到了很多用户的诟病,这成为了Layer-2出现和发展的契机,也促进了很多非以太坊公链的发展和壮大, Solana 和 Avalanche 是最大的受益者。

因此,随着新一轮牛市的到来,更多的二层和非以太坊公链的使用场景和可能性将会被发现。

以太坊自然也不甘落后;

2024年,我们可能会见证公链生态和代币的新一轮繁荣。

此外,作为对BTC最新应用的探索,BRC-20的发展也不容忽视。

作为 2023 年出现的基于 BTC 网络的新代币发行标准,BRC-20 允许用户基于 BTC 网络部署标准化合约或铸造 NFT,为最古老、最成熟的公链提供新的叙述和用例。

随着流动性的回归,BRC-20相关应用的探索和开发可能会逐渐开始,并与其他公链生态一起在新的“温和但长期”牛市中取得长足进步。

比特币的价格在日线图上呈上涨趋势。

来源:

Tradingview 上的 BTCUSDT

封面图片来自 Unsplash,图表来自 Tradingview

用戶喜愛的交易所

已有账号登陆后会弹出下载

![[卡尔]卡尔达诺(ADA)在多个方面超越了以太坊(ETH):详细信息](/img/20240122/3288496-1.jpg)

![[ADA(卡尔达诺)]卡尔达诺基金会发布2023年活动报告](/img/btc/91.jpeg)

![[琼]卡尔达诺创始人揭开卡尔达诺(ADA)成功背后的神秘面纱](/img/btc/140.jpeg)

![[卡尔]阿联酋警方与卡尔达诺(ADA)合作打击犯罪分子](/img/20240312/3813018-1.jpg)

![[卡尔]Blofin 的加密货币假日特别节目:过去、现在和未来](/img/20240102/3106387-1.jpg)

![[卡尔]2024 年您需要了解的加密货币交易所](/img/btc/114.jpeg)