时间:2024-05-29|浏览:236

Audius 加密货币是 SoundCloud 和 Spotify 等音乐流媒体平台的 Web 3 版本,其原生代币 $AUDIO 上周飙升 27.4%,Convert 上的交易量增长了 21 倍。Audius 被《Business Insider》评为最值得关注的 14 家音乐科技初创公司之一,这推高了代币的价值并推高了需求。

Megadrop 区推出的第一个项目 BounceBit ($BB) 上周涨幅高达 92.4%,Convert 上的交易量跃升 381.0%。BounceBit 是 CeDeFi 基础设施领域的领先项目,提供机构级收益产品、重新质押用例和 CeDeFi 即服务,让所有人都能获得高收益机会。在项目团队宣布通过结合中心化和去中心化金融来实现高收益比特币投资民主化的路线图后,该项目取得了强劲表现。

上周四下午,美国证券交易委员会批准了以太坊现货 ETF 的 19b-4 表格,为 ETH 现货 ETF 的批准铺平了道路。Uniswap ($UNI) 在其去中心化平台上的交易量激增,占 DEX 总交易量的 48.9%。此外,项目团队推出的 Uniswap V4 刺激了对这种治理代币的需求。

Meme 币继续在市场中扮演重要角色,ConstitutionDAO ($PEOPLE) 和 Pepe ($PEPE) 表现优异,获得市场关注。上周,$PEPE 在 Convert 上的交易量实现了两位数增长,而 $PEOPLE 的交易量实现了三位数增长。

整体市场

上图显示了过去三个月 ETH 的价格走势。

上周四,美国证券交易委员会终于批准了以太坊现货 ETF 申请人的 19b-4 表格,为 ETH 现货 ETF 的最终批准铺平了道路。ETF 发行人必须等待 SEC 批准 S1 表格后才能将其 ETF 上市供投资者购买。通常,这还需要一到两周的时间。

周四,在SEC网站公布19b-4表格批准消息之前,ETH价格出现震荡,先是在美股开盘前上涨至3950美元,随后由于SEC决定不明确,在美股收盘时迅速跌破3500美元。高波动性(从上到下变化超过10%)在期权市场上得到了正确的定价,近期限ETH期权的隐含波动率超过110%。公告发布后,隐含波动率迅速回落至正常范围。

Following the SEC announcement, we saw some ETH sales during the Asia hours, and demand increased after the price reached the green bar shown in the chart. Demand came in consistently, pushing the price into the red bar, which represents a strong resistance area at the $4,000 level. We expect the resistance level to be broken with the announcement that the S1 forms have been approved by the SEC, and we could see another 10% room to run before the ETFs are available in the stock market.

Options Market

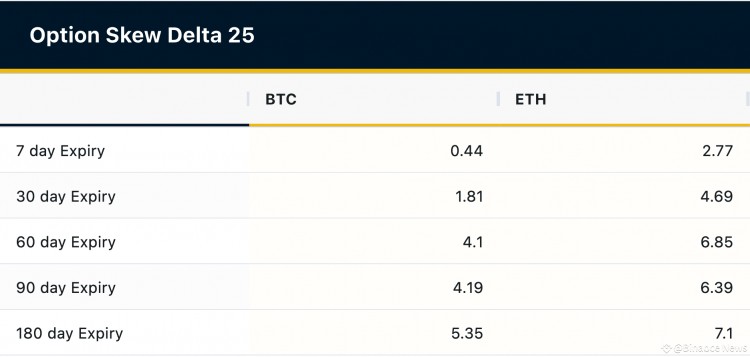

The above table shows the 25-delta skew of BTC and ETH options with different tenors.

Last week, before the SEC approved the 19b-4 forms on ETH ETF applications, we saw a heavily skewed market behaviour towards puts on ETH near-tenor options, indicating that options traders were purchasing downside protection against the "sell the news" behaviour.

This week, the 25-delta skew on ETH options of various tenors is all positive, indicating that options traders are optimistic about ETH's recent price movement, with longer-tenor options showing a stronger bullish sentiment.

Meanwhile, sentiment on BTC options is less bullish, with only 0.44 readings for 7-day expiry. However, sentiment indicates more bullishness for longer-term options.

According to the table above, the market is strongly bullish on both BTC and ETH over the next two months, with ETH outperforming. This observation supports our previous prediction that the market correction that began in March is coming to an end, and that BTC may reach a new all-time high this summer, paving the way for the start of the altcoin season.

Macro at a glance

Last Wednesday (24-05-22)

The Federal Open Market Committee (FOMC) meeting minutes revealed that it might take longer than previously thought to confidently achieve a sustainable inflation rate of 2%. Many participants expressed readiness to tighten policies further if the inflation risks developed to warrant such action. With the market wary of possible further delays in Federal interest rate cuts, U.S. equities closed in a slump, with the S&P and Nasdaq indexes down by 0.77% and 0.70%, respectively. Nonetheless, the crypto market performed better, largely due to robust demand for Ethereum before the potential approval by the SEC on ETH ETFs.

Last Thursday (24-05-23)

US initial jobless claims dropped to 215k last week from 223k the week before, better than the estimated 220k.

The S&P Global U.S. Manufacturing PMI for May was recorded at 50.9, surpassing the projected 50.0. Furthermore, the S&P Global U.S. Services PMI came in at 54.8, significantly exceeding the expected 51.2. This indicates that US business activities are expanding. Manufacturers reported an increase in prices across various inputs, suggesting potential growth in goods inflation in the coming months.

Last Friday (24-05-24)

The durable goods orders in the U.S. documented a growth rate of 0.7% month-on-month in April, surpassing the projected decrease of 0.9%.

周二 (24-05-28)

美国5月消费者信心指数攀升至102.0,较4月的97.5大幅反弹,并超过预期的96.0。强劲的消费者信心意味着商品和服务需求可能增加,这可能导致更持续的通胀。

本周晚些时候,我们

2024 年第一季度美国 GDP

欧元区5月份的CPI数据,这可能为欧洲央行6月份可能降息提供更多见解。

美国4月份PCE指数,这将为进一步了解美国通胀和美联储的利率决定提供依据。

转换门户体积变化

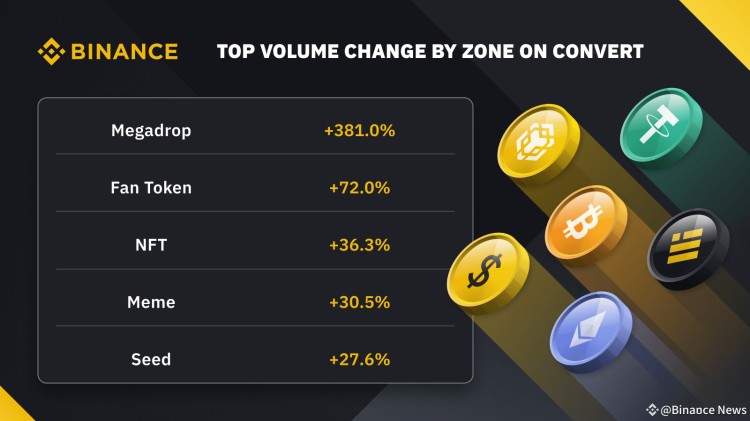

上表显示了我们的转换门户上各区域的成交量变化。

本周,我们在 Convert 上的交易量大幅增加,其中 Megadrop 区域的百分比增幅最大。

上周,Megadrop 专区首个上线项目 BounceBit ($BB) 表现亮眼,吸引了大量交易需求,交易量较首周交易量飙升 381.0%。

上周,Convert 上粉丝代币区的交易量增长了 72.0%。桑托斯足球俱乐部粉丝代币 ($SANTOs) 是该区交易量增长的主要推动力。

在同一时期,NFT 区的交易量增长了 36.3%。Audius ($AUDIO) 和 Origin Protocol ($OGN) 是交易需求旺盛的两个主要贡献者。

为何进行场外交易?

币安为客户提供多种方式进行场外交易,包括聊天沟通渠道和币安场外交易平台(https://www.binance.com/en/otc),用于手动报价、算法订单或通过币安转换和大宗交易平台(https://www.binance.com/en/convert)和币安转换场外交易 API 进行自动报价。

如需了解更多信息, 请发送电子邮件至:

trading@binance.com 。

加入我们的 Telegram ( https://t.me/BinanceOTC )以随时了解市场动态!

用戶喜愛的交易所

已有账号登陆后会弹出下载