时间:2024-03-20|浏览:317

Original author: Mary Liu

Original source: BitpushNews

Bitcoin continued its decline on Tuesday, falling more than US$10,000 from last week's historical high to an intraday low of US$62,320.30. Bitui terminal data showed that as of the close of the US stock market that day, BTC's decline had narrowed, hovering around US$64,000, 24 The hourly drop is approximately 5%.

The altcoin market continued to fall amid Bitcoin's weakness, with Ethereum down more than 4% to trade at $3,335.66 at the close, SOL down 8%, and Dogecoin down 5%. Most coins in the top 200 posted losses on Tuesday, with just six coins posting double-digit gains.

DeFi protocol Ondo (ONDO) led the gains with a 14.5% gain, followed by Fantom (FTM) with a 14.3% rise and Open Campus (EDU) with an 11% gain. Solana-based DeFi protocol Raydium (RAY) and Ethereum-based DeFi protocol Mantra (OM) were the biggest losers, down 18.6% and 13.8% respectively, while Jupiter (JUP) fell 12.9%.

Crypto-concept stocks fell under pressure, with MicroStrategy falling 5% and cryptocurrency exchange Coinbase falling 4%. Crypto-mining stocks initially fell across the board, but some closed higher. Riot Platforms and Marathon Digital, the largest mining companies, fell 3% and 0.5% respectively. .

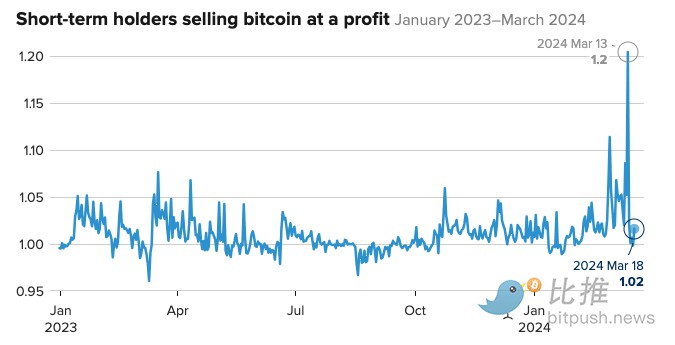

Bitcoin has been weakening since last week, with some investors taking profits. Data from CryptoQuant shows that on March 12, there was a significant increase in the number of short-term holders selling Bitcoin at a profit.

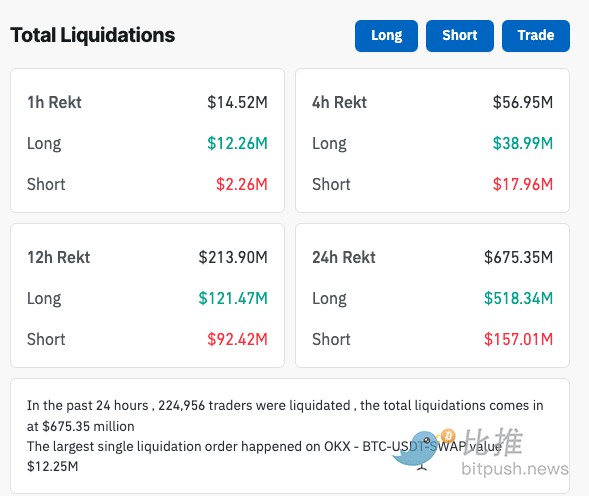

Additionally, profit-taking led to a surge in long liquidations of leveraged Bitcoin positions. According to CoinGlass data, in the past 24 hours, the long liquidation amount of various centralized exchanges was approximately 518 million U.S. dollars. Yesterday’s long liquidation amount was 122 million U.S. dollars, and the long position liquidation amount from Wednesday to Friday last week was approximately 372 million U.S. dollars. Dollar.

Bartosz Lipiński, CEO of Cube.Exchange, said: “As ETFs purchase the available Bitcoin supply on the open market and continue to reduce liquidity, these situations may become more frequent and may lead to concerns about the integrity of Bitcoin pricing. Lose confidence and start looking at other crypto assets. Overall, this pullback is short-lived and the recovery of the rebound makes sense - although the specter of a recession looms over the market next year and could end up in a way we may not foresee way to curb the backlash.”

Analysts at Bitfinex exchange said in a report: “Given Bitcoin’s recent all-time high and subsequent correction, we expect the market to undergo a period of readjustment as investors inundate spot Bitcoin ETFs amid unprecedented inflows. Seeking balance.”

Joel Kruger, market strategist at LMAX Group, said in an email report, “The Federal Reserve’s decision this week poses risks, with concerns about strong U.S. economic data and inflation leading to a policy stance that is less friendly to investors. Although cryptocurrencies and traditional Correlations between assets are low, but risk aversion from the Fed’s decision could spill over into the cryptocurrency space.”

Market analyst Bloodgood said in his latest market report: “Bitcoin’s halving is still a month away, so a pre-halving decline is no surprise given Bitcoin’s recent performance. In the meantime, everyone All eyes are on tomorrow's Federal Open Market Committee meeting, especially as markets appear to be reducing expectations for a rate cut this year, and while the consensus on the current Fed rate decision is largely unanimous - that rates will remain unchanged - — but any comments about the future direction of monetary policy will send shock waves through the market. Of course, this means that holding leveraged positions during the press conference will be riskier than usual."

The current total market value of cryptocurrencies is US$2.39 trillion, and Bitcoin’s market value dominance rate is 52%.

用戶喜愛的交易所

已有账号登陆后会弹出下载