时间:2024-02-22|浏览:345

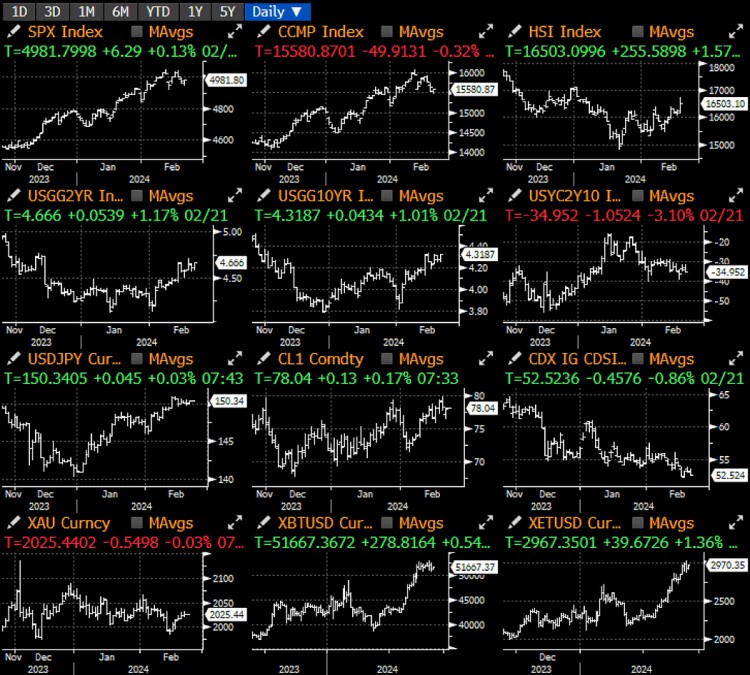

Yesterday, all the focus was on Nvidia. The AI chip giant once again delivered results that exceeded expectations in both revenue and net profit.

Revenue reached $22.1 billion, beating expectations of $20.4 billion (last year was "only" $6 billion), with data centers accounting for 83% of the performance. Gaming revenue increased 58% year over year to $2.9 billion, while gross margins Maintained at 76.7%, higher than last year's 66.1%; net profit reached $14.8 billion, exceeding expectations of $13.1 billion, while free cash flow also reached $11.2 billion, higher than expectations of $10.8 billion.

On top of that, the company raised its first-quarter revenue forecast to $24 billion (vs. $21.9 billion expected), with margins also expected to remain around 77%. In addition, CEO Jen-Hsun Huang confidently stated that “accelerated computing and generative AI have reached a critical point, and demand from companies, industries and countries around the world is surging.” “Demand from vertical industries led by automobiles, financial services, and healthcare is currently also reaches the level of billions of dollars.”

In other words, let’s welcome our new AI overlords.

The company's shares were up about 9% in after-hours trading, slightly below the options daily breakeven point, but the positive result could support continued gains in risk assets in the near term.

The market was relatively calm before the release of the earnings report. The minutes of the January FOMC meeting released by the Federal Reserve were relatively "outdated" because the meeting was held before the release of strong non-farm payroll data and CPI/PPI. However, the minutes still had a tough hawkish tone. , the committee expressed concern about prematurely declaring victory in the inflation battle. Some news headlines include:

Fed meeting minutes: Most officials pointed to risks of cutting interest rates too quickly

Some officials believe the inflation process may stall

Officials say demand may be stronger than assessed

Balance sheet discussion guides final balance sheet reduction decision

Several officials pointed to potential risks that loose financial conditions could bring

Overall, officials chose to focus on "stalling" inflation progress, stronger-than-expected demand and a "final" decision to slow down the balance sheet to solidify their resistance to a rate cut starting in March.

A similar sentiment was echoed by the Richmond Fed's Barkin, who said that while overall inflation has improved, recent economic data highlights that price pressures in some sectors remain too high. Several Fed officials will be speaking today, including Bowman, Cook, Harker, Kashkari and most importantly Waller, although we don't expect them to make any disruptive comments at this time.

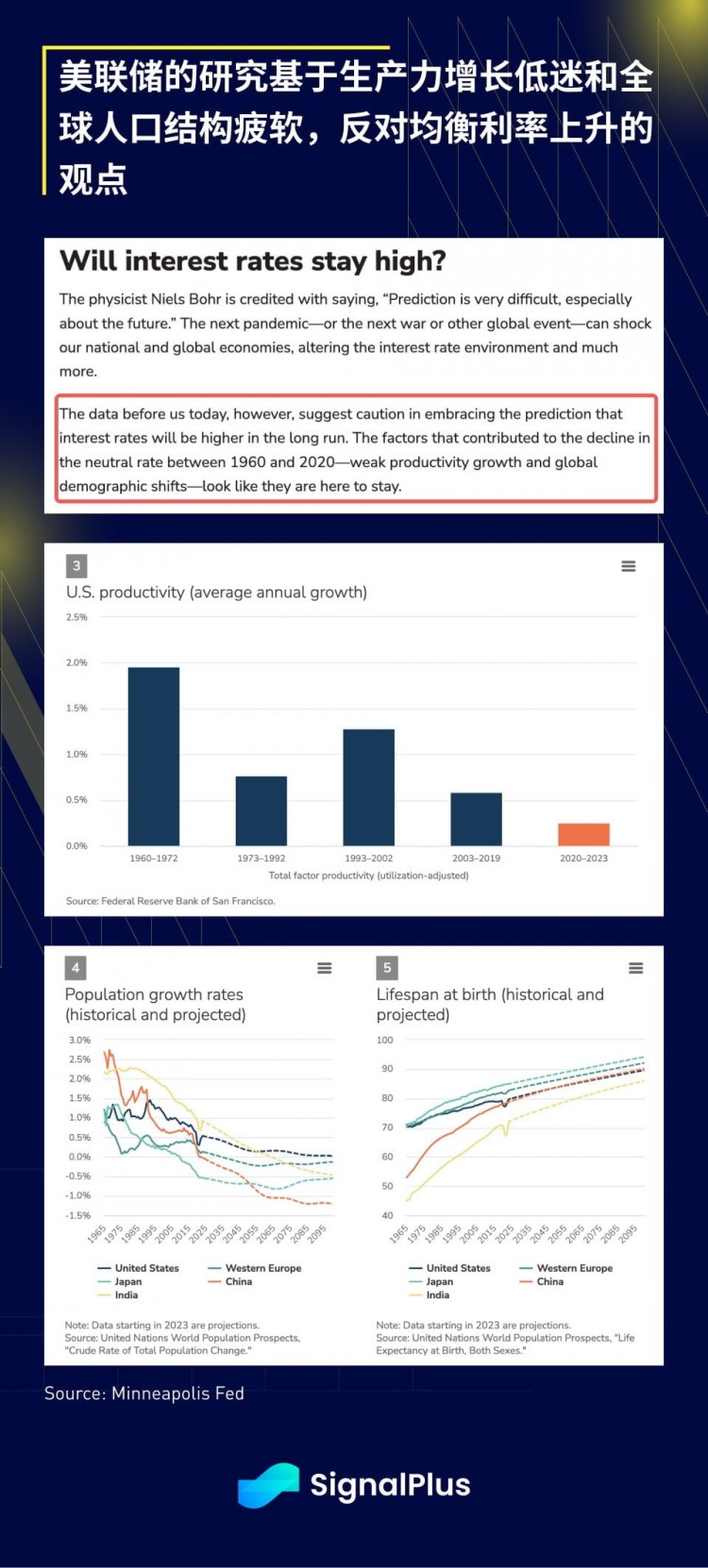

On the other hand, a Minneapolis Fed working paper delves into the controversial "R-star" issue, what academics call the long-term equilibrium interest rate, concluding that as U.S. productivity growth continues to be sluggish, the neutral interest rate may Subject to constraints, this thinking also feeds into the Fed's long-term forecasts for monetary policy.

In terms of cryptocurrency, Bloomberg reported that a major SEC litigator responsible for cases such as Coinbase and Ripple is leaving to join White & Case, a law firm with 2,600 employees, to become a member of a defense team specializing in cryptocurrency and the Internet field. Members, this is a further sign of a shift in prevailing trends.

In her first public interview, she said:

“Cryptocurrencies are here to stay – something that has become abundantly clear with the launch of a plethora of Bitcoin ETFs,” “Given their complexity and volatile law enforcement environment, the legal issues surrounding cryptocurrencies will be the most significant for some time.” One of the important issues.”

With trends turning so fast, should we expect Gensler to join Coinbase as a special advisor after his public service ends? Such an interesting time…

用戶喜愛的交易所

已有账号登陆后会弹出下载

![[涡流]Heather Cerlan领导的Bethesda团队制作多人合作RPG模拟游戏](/img/20240306/3720699-1.jpg)