时间:2024-02-07|浏览:297

)为首的盘整阶段,最近几天

比特币一直保持在 42,000 美元

支撑区域上方。

当

投资者驾驭当前的价格走势时,他们正在敏锐地观察在

牛市

中可能产生可观回报的资产

。

值得注意的是,在即将到来的比特币减半和可能推出现货以太坊交易所交易基金( ETF )等因素的推动下,市场预计将出现看涨情绪。

与此同时,市场上有各种 加密货币 ,如果投资者以当前价格进入,这些加密货币将提供获得巨额回报的机会。 在此背景下,Finbold 确定了以下三种加密货币,它们有可能将 100 美元的投资变成 1,000 美元。

索拉纳 (SOL)

Solana( SOL )经常被誉为“以太坊( ETH )杀手”,近几个月来出现了大幅增长,这主要是由网络活动增加推动的。 这是在 SOL 克服 FTX 交易所崩溃带来的挑战之后发生的。 该代币在过去一年经历了显着的飙升,达到了超过 121 美元的年度高点。

最近价值的上涨可归因于对最近流行的 Solana 网络模因币的需求。 例如,最新的 meme 代币 WEN 被空投给用户,部分推动了 Solana 地址的大幅增加, 2024 年 1 月 新增 了至少 1000 万个地址。

与此同时,随着加密货币 Saga 智能手机的成功,该网络也引起了人们的关注。 继 Solana 首款智能手机获得积极反响后,第二个版本的预订量在一小时内迅速达到近 30,000 份,表明需求不断增长。

最近的事态发展还 表明, 网络上的购买压力不断增加,以交易量等里程碑为标志。 1 月份,交易额达到 1 万亿美元,创多年新高,较 2023 年 12 月增长 30%。

这种活动的增加可能会为 Solana 提供更实质性的基本面支持,从而可能引发 SOL 价格飙升。 此外,更广泛的市场牛市可能是持续上涨的关键催化剂,有可能将 100 美元的投资转化为丰厚的回报。

截至发稿时,Solana 交易价格为 97.51 美元,周跌幅约为 0.1%

链环 (LINK)

Chainlink (LINK) has solidified its role as a vital element in the decentralized finance (DeFi) sector by offering decentralized oracle services that connect smart contracts and real-world data. The reliability and security of Chainlink’s decentralized oracles have positioned it as a crucial component in numerous blockchain projects, contributing to the steady ascent of the LINK token’s value.

In recent days, LINK has experienced a noteworthy surge, propelling the altcoin market to new heights. This surge in buying pressure resulted in LINK surpassing Tron (TRX) to become the 11th largest cryptocurrency based on market capitalization.

Currently, Chainlink is eyeing new price milestones, with the $20 mark identified as the next target, driven by significant on-chain activities.

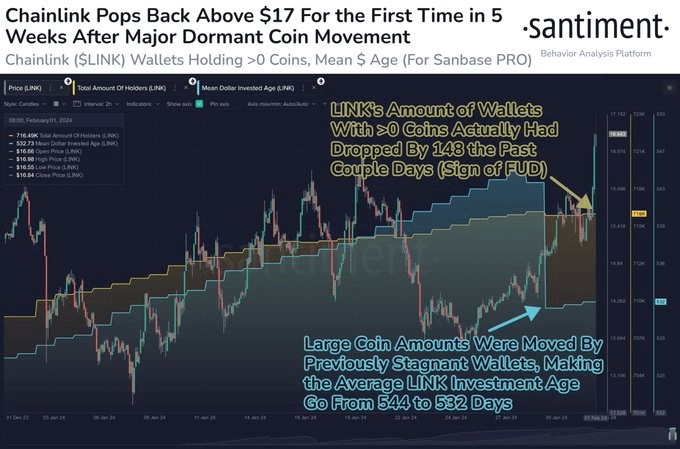

In this line,databy Santiment highlighted a surge in previously dormant wallets, leading to the highest Age Consumed spike for Chainlink, measuring 5.38 billion. The Age Consumed metric is derived by multiplying the coins’ movement by the number of days those coins had been inactive. This influx of LINK back into the network’s circulation has played a pivotal role in the recent upswing.

In the broader context, as the demand for decentralized finance solutions expands, Chainlink is strategically positioned to benefit from the growing DeFi ecosystem. This makes it an attractive investment for those seeking to capitalize on the decentralized future of finance.

By press time, LINK was trading at $18.32 with daily gains of over 2%.

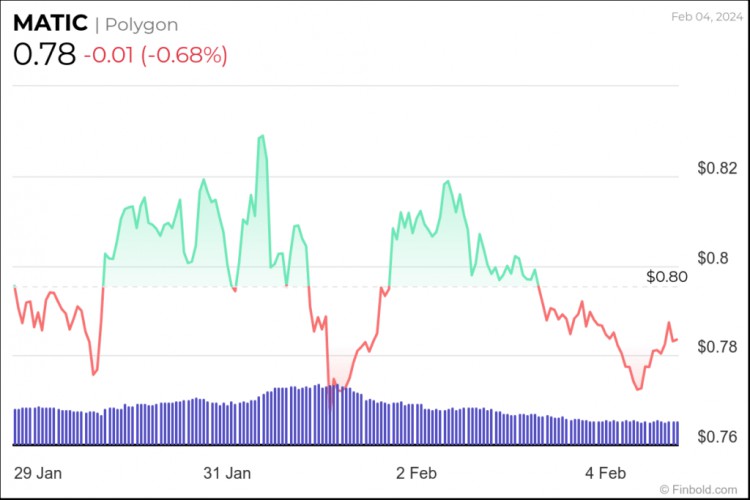

As a Layer 2 scaling solution for Ethereum, Polygon (MATIC) has garnered widespread acclaim for effectively addressing scalability challenges within the Ethereum network.

By furnishing a framework that facilitates the creation and interconnection of Ethereum-compatible blockchain networks, Polygon elevates the functionality and efficiency of decentralized applications. The MATIC token has demonstrated significant price appreciation as the platform continues to gain popularity.

With a diverse range of projects actively developing on the Polygon platform, a $100 investment in MATIC can benefit from the network’s growing significance in the broader blockchain landscape. Additionally, MATIC can potentially experience a rally during a bull run, given its historical tendency to closely align with the overall market trends.

By press time, MATIC was valued at $0.78 with weekly losses of about 2%.

Ultimately, while these projects offer promising opportunities supported by robust fundamentals, it’s essential to emphasize that their success will primarily hinge on the prevailing market sentiments.

用戶喜愛的交易所

已有账号登陆后会弹出下载