时间:2023-12-21|浏览:396

Recently, the Guangdong Provincial Higher People's Court issued a warning through its official WeChat public account, saying that a defendant used cash to purchase the USDT US dollar stablecoin from retail investors in the currency circle at a price lower than the platform price, and then resold it at the exchange rate of the US dollar that day, earning the middle price difference and profit from it. Li, this move is like buying and selling foreign exchange in disguise, which will impact the RMB and the country's foreign exchange reserves. It has constituted an illegal business crime and will be punished with a maximum sentence of more than 5 years in prison.

Stablecoin is one of the important infrastructures in the crypto industry. It achieves the stability of currency value by anchoring the legal currency of a certain real country. Ordinary users use it as an important means of storing value and payment, while Web3 institutions use it as an operating tool. , abundant demand has created a booming stablecoin market.

However, with the rapid development of the encryption ecosystem in the past few years, stablecoins are increasingly used in various risky activities, providing more hidden and convenient value for online gambling, online black industry, money laundering and other activities. transfer method.

USDT money laundering methods

"Benchmarking" is the name of criminals for money laundering activities. The purpose of this type of activity is to transfer the payments of high-risk users to the accounts of low-risk users for payment, thereby circumventing the risk management and control measures of payment institutions. Traditional benchmarking uses personal accounts such as banks, WeChat, and Alipay to transfer, split, and withdraw funds involved in the case. In recent years, cryptocurrency—especially stablecoins—has become a new benchmarking tool.

The usual model is that the benchmarking platform recruits various personnel to register for cryptocurrency trading platform accounts and bind their own bank cards, allowing the benchmarking personnel to receive orders on the platform and go to the OTC section of the exchange to purchase a specific amount of USDT at the market price. And it is recycled to the benchmarking platform at a higher price, and the price difference is the income of the benchmarking personnel. In fact, the funds recovered by the benchmarking platform in USDT are the funds involved in the case. In this way, the benchmarking platform can launder the funds without having to personally handle legal currency.

The profits of the benchmarking platform come from the dispatch of orders in the more upstream links, including online gambling, black and gray industry, money laundering and other activities. Different risk categories have different commission rates for the funds involved. For example, gambling funds are regarded as lower-risk funds. , so the commission is low, and fraudulent funds are often considered high risk, so the commission is high, and some benchmarking platforms even refuse to accept it.

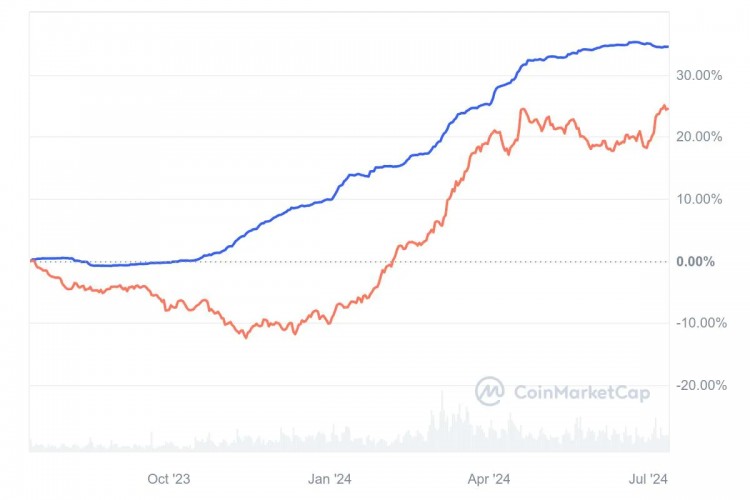

The difference in commissions is directly reflected in the exchange rate of USDT transactions. Higher-risk funds mean higher price increases. In the practice of case investigation, it is not difficult for us to encounter illegal USDT transactions with prices above 8 yuan or even 10 yuan.

Illegal payment and illegal property

So far, most of the various low-price USDT transactions on the grounds of "black U moving bricks" or "black/white money collecting U" are fraudulent activities. Although law enforcement agencies have severely cracked down on this, there are still quite a few black and gray USDT trading scenarios below the market exchange rate, taking illegal payment platforms as an example. Some payment platforms accept USDT recharges and use legal currency funds to help users make payments on other platforms, including online gambling platforms, fund settlement of member funds, live broadcast platforms for gifts, e-commerce platforms for orders and even payment of wages to employees, etc. .

The payment platform does not identify the source of the user's USDT, nor does it have a complete KYC mechanism, so a large amount of risk funds are poured in. This is why the source of the encryption address handling fee and the destination of the illegal income in some cases are displayed on the chain. The address associated with the online gambling platform. Using this almost anonymous transaction method to realize cash, black and gray industry practitioners do not need to register a centralized and compliant cryptocurrency trading platform account, greatly reducing the possibility of being "frozen".

Case investigation practice shows that USDT in such illegal payment activities often fluctuates between 0.05 yuan and 0.3 yuan relative to the market exchange rate. The specific degree of decline depends on the source of legal currency funds of the payment platform and the size of the user's funds.

The above two risk scenarios indicate that cryptocurrencies, mainly stablecoins, are being maliciously used by money laundering gangs. In order to avoid sanctions from centralized trading platforms and law enforcement agencies, criminals will obfuscate funds through the encrypted addresses of illegal entities. Or use over-the-counter transactions to block the fund analysis link. Illegal USDT transactions that deviate significantly from the market exchange rate are a typical feature.

Summarize

In short, the abuse of stablecoins has had a serious negative impact on the industry. In order to protect the development of the encryption industry and the rights and interests of users, all parties should work together to strengthen supervision and compliance measures and improve the security and transparency of stablecoins. Only through cooperation and innovation can stablecoins be ensured to play a positive role in the crypto industry and contribute to the stability and sustainable development of the digital asset market.

热点:usdt

用戶喜愛的交易所

已有账号登陆后会弹出下载